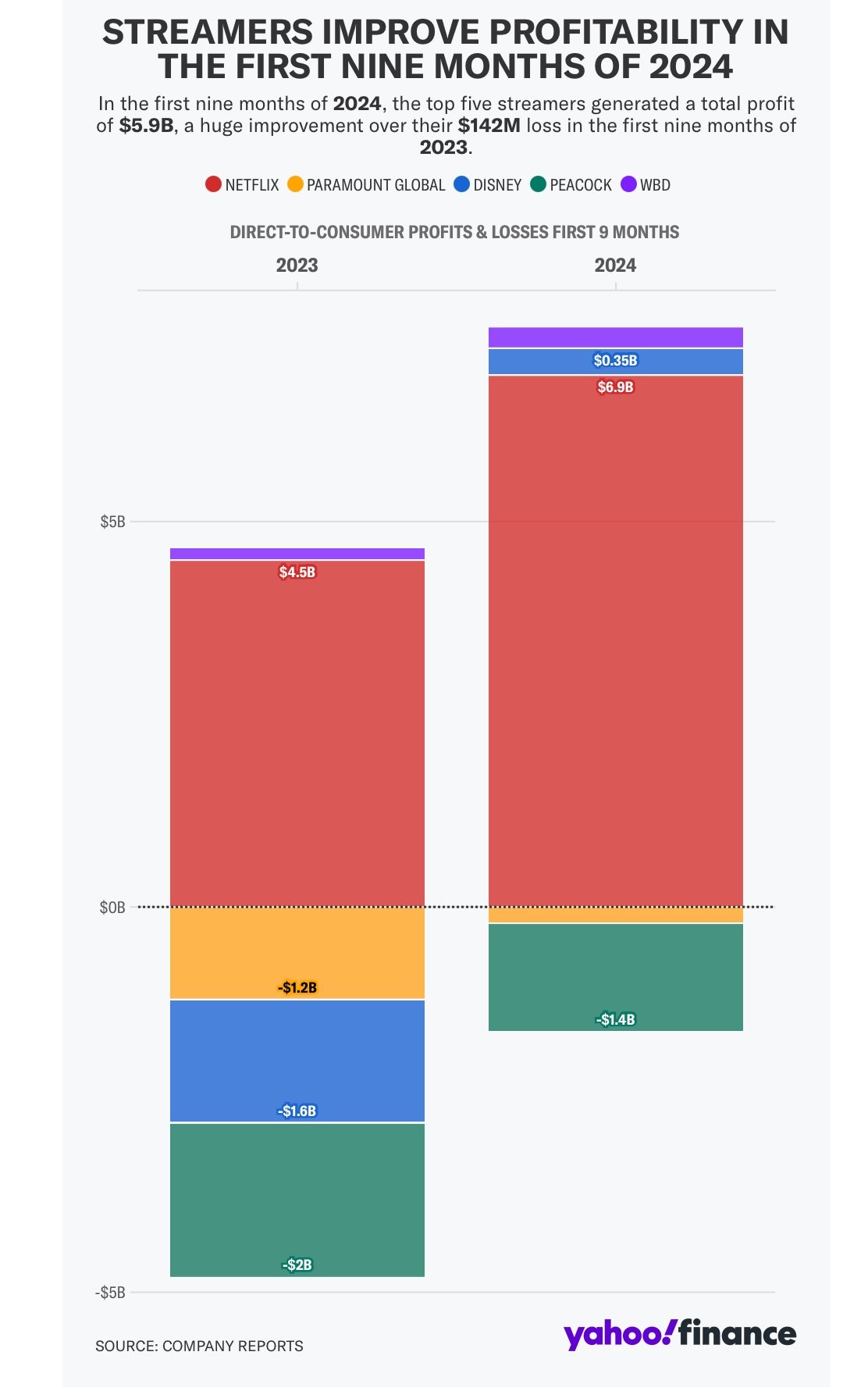

Streaming video turned good profits in 2024 with over $5.9B, after years of pricey content, user churn, and lots of competition.

©Yahoo! Finance

The top five streaming video platforms generated over $5.9B in profits in the first 9 months of 2024:

• Netflix

• Paramount Global

• Disney

• Peacock

• Warner Brothers & Discovery’s Max (WBD)

The big question on everyone’s minds are, “Will this continue into 2025?” For now, the answer remains unknown. but 2024 results are definitely promising.

For many years, streaming services, no matter how much they were hyped, failed to deliver viable profits. Factors holding the world’s largest media companies from winning on this new frontier, included tons of competition, expensive content, and user churn.

However, last year, in 2024, the five biggest players, Netflix (NFLX), Disney (DIS), Paramount (PARA), NBCUniversal's Peacock (CMCSA), and Warner Bros. Discovery's Max (WBD), reported profits for the first time. Spanning nine months, these five companies alone delivered earnings of roughly $5.9 billion.

This profitability is significant not only for the factors aforementioned, but also since it is a 360-degree shift from 2023, just a year prior, where the group cumulatively reported a $142 million loss. Clearly, staying in the market, offered gains despite the naysayers and shifting landscape of investors behind the scenes.

Netflix, unofficially labeled the winner of streaming wars by Wall Street, led the gains, with $6.9 billion in just the first three quarters of 2024. This week the company also reported another $1.87 billion in profits and almost 20 million more subscribers than before. In 2000, Netflix Reed Hastings and Marc Randolph tried to sell Netflix to Blockbuster for $50 million and a 49% stake in the company. Blockbuster, then a popular walk-in retail store, turned them down, considering the service a niche market with limited appeal. Over the next decade, Netflix grew in popularity, appealing to Blockbuster’s core customers who loved streaming video over the Internet. By 2010, Blockbuster filed for Chapter 11 bankruptcy protection. Today, Netflix is worth $417.8 billion. Led by CEO Ted Sarandos, Netflix’s subscription service primarily distributes original and acquired films and television shows from various genres, and it is available internationally in multiple languages.

© Netflix via Google

The remaining four media companies will also soon be reporting their own fourth quarter results in just a few days by January 30. Disney and Paramount Global both reported strong profits from streaming in their first quarters while Peacock decreased its losses year-over-year, and WBD ended the year with a good showing. Despite these good returns, some analysts do not consider this strong enough beyond breakeven with only Netflix showing significant gains.

Considered part of the coveted FAANG series of stocks, Netflix has come a long way from its early days as a DVD mail subscription service in 1999 to being a movie-streaming behemoth today. With Nvidia’s popularity today, there is some discussion about the GPU and AI software and systems maker replacing Netflix in the popular acronym or possibly adding another ‘N’ to the list.

Profitability is often based on scale and consistent revenue growth year after year, and thereby, needs ongoing progress. Traditional media companies can take longer to see this because their existing businesses prior to streaming, are declining and they are more dependent on streaming to keep them profitable.

In November 2019 when Disney launched its flagship platform, Disney+, “streaming wars” quickly ensued in a race to gain content, talent, and subscribers and secure the most popular shows. Last year’s reports reveal the progress that has occurred in the streaming media industry in the last five years.