Betting Big on Metaverse, Microsoft Buys Activision Blizzard for $75B, in its Largest Acquisition

Billboard in New York City, pitching Activision’s “Call of Duty: Vanguard.” © Richard Levine, Zuma Press

Powering its way to becoming the gaming platform of choice, Microsoft (Nasdaq: MFST) acquires Activision Blizzard (Nasdaq: ATVI) for $75 billion with clear intentions to shake up the gaming industry. Through its acquisition, Microsoft aims to build out its own content library of popular games and blockbusters such as “World of Warcraft,” “Call of Duty,” “Candy Crush” and more to attract consumers to join its cloud gaming service, Game Pass.

Game Pass offers plenty for subscribers from its cloud gaming to a multiplayer support online and access to an extensive collection of games. Microsoft said subscribers to Game Pass have increased 39% in 2021 to 25 million. Consumers spent $3.7 billon on cloud-based games in 2021, with Microsoft’s Game Pass making up 60 percent of that, according to date compiled by research firm Omdia. Omdia expects game revenue to reach $12 billion in 2026.

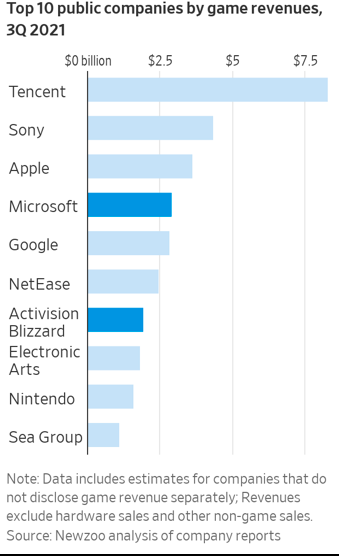

The new games would also join Microsoft’s lucrative Xbox console business, home to consumer favorites such as Minecraft and Doom. When the sale completes, Microsoft would become the world’s third largest gaming company by sales after China’s Tencent Holdings Ltd. and Japan’s Sony Group Corp. with 30 game studios under its umbrella and overtaking Apple for the third slot.

Today over three billion people play video games. Gaming is increasingly growing in popularity given the rise of interactive high quality entertainment and many avenues for engagement — online on any Internet-connected device with a screen and via consoles.

Microsoft’s acquisition of Activision Blizzard will “accelerate the company’s gaming business across mobile, PC, console and cloud and will provide building blocks for the metaverse,” according to a press release provided by the company Tuesday.

Activision Blizzard has studios all over the world, and employs approximately 10,000 employees.

With Activision Blizzard’s 400 million monthly active players in 190 countries and three billion-dollar franchises, Microsoft’s Game Pass will offer one of the most attractive, comprehensive and diverse gaming content collections in the entire industry. After sealing this deal, which is expected to close after 2023 upon regulatory approval, Microsoft will have 30 internal game development studios, as well as new publishing and e-sports production capabilities.

With almost 95% of all players globally playing games on mobile devices, mobile is rapidly becoming the preferred platform. By uniting the popular immersive franchises and world-class talent of Activision Blizzard with the powerful technology of Microsoft, players of "Halo" and "Warcraft," will be able to play at any time, anywhere.

Pre-Microsoft Deal Gaming Data. Figure via WSJ

With plenty of cash on its balance sheet and intelligent management, Microsoft is able to purchase Activision in an all-cash deal in its largest acquisition ever.

Approximately ten years ago, Microsoft began to move its corporate clients to the cloud on a subscription basis. This move enabled it to grow and hit a $2 trillion market valuation, cementing its position as a top tech company. At the same time, the company removed less profitable endeavors and cleaned up house with efficient management under its CEO Satya Nadella.

Image via Microsoft

Years of Preparation

Years in the making, Microsoft’s substantive commitment to gaming initially took a backseat. When Satya Nadella took over as CEO in 2014, he emphasized the importance of building out the company’s enterprise customer cloud-computing services. This singular focus enabled Microsoft to become the world’s second most valuable company after Apple Inc. with a $2.3 trillion valuation.

For a while, Microsoft’s Xbox unit floundered as the company’s focus remained squarely on enterprise business to business products and services. Xbox did not report to the CEO and functioned under the Windows operating system. Gaming however remained Microsoft’s primary touchpoint with consumers and a few years ago, Microsoft began to expand its cloud usage to gaming. Interest in growing the company’s business beyond enterprise also gained traction as a method of diversification. Microsoft began exploring acquisitions of consumer businesses such as TikTok, Discord and others. It also began to quickly buy up game makers, spending over $10 billion to buy game studios and build its own extensive collection including the Doom franchise that it bought last year.

As Microsoft has fully embraced gaming. Xbox has won its own seat at the table and now is poised to grow exponentially with the addition of Activision’s extremely popular consumer games. Microsoft’s ability to offer cloud-based gaming also opens up gaming to more consumers who do not have to buy expensive hardware such as consoles and computers and can play the games on their existing smartphones. Streaming games similar to the way movies and television shows are now being watched online, enables Microsoft to take an early lead in this lucrative market.

It’s clear that the company has large aspirations when it comes to gaming and has been pursuing this goal for a while through systematic acquisitions of smaller game studios and now its largest deal with Activision to build out its subscription gaming business model and Game Pass. Activision has almost 400 million active users every month currently. If Microsoft can convert some of these users into subscribers, it can substantially boost its cloud-based gaming business.

Action in Microsoft’s “Halo Infinite.” ©Handout/Agence France-Presse/Getty Images

Cloud-Based Gaming

Similar to watching movies and television on a smartphone or computer, cloud gaming enables a consumer to stream and play a game using any internet-connected device with a screen. Streaming games is more data intensive than streaming YouTube videos for example, and requires more infrastructure — something that Microsoft is happy to provide. Netflix has offered only a few games that all require download and cannot be streamed via the cloud.

At Microsoft’s announcement yesterday, Nadella said that Microsoft plans to bring in as many Activision games as it can into Game Pass. Previously, Microsoft has brought in games from developers that it purchased, to Xbox consoles and Game Pass and made them exclusive. This includes several Triple-A or AAA games, which are big-budget titles known for exceptional high quality content and large, active subscriber user bases.

“We do think our investment in cloud creates a unique capability for triple-A content to reach any screen on any device.”

As Microsoft expands on its cloud-based gaming business, the company will able to further diversify into consumer-facing businesses, which will affect the dominance of both Amazon’s cloud services and Sony’s PlayStation in terms of gaming hardware. This step of growing cloud computing enables Microsoft to lead in a variety of different and separate businesses ranging from enterprise software and data storage to consumer advertising.

The gaming industry has been growing considerably in recent years and gaining more attention due to frequent mergers and acquisitions. Pitchbook reports that M&A deals have gone up from $8.9 billion in 2020 to $26.2 billion in 2021, while venture capital deals climbed from $6.4 billion to $11.2 billion. Others like Blockchain gaming platform developer Forte have significantly added to their war chests by raising venture capital.

Acquisition Also Means Taking On Activision’s Woes

This large acquisition may spur antitrust scrutiny since larger deals have come under the microscope in recent years. Microsoft’s purchase of Activision also includes dealing with the video gaming company’s troubles.Activision’s CEO Bobby Kotick who has led the company for three decades, will also be leaving the company in the wake of workplace misconduct claims, according to reports cited by the Wall Street Journal in November of last year.

Image via Microsoft

Metaverse Plans

Discussions about the metaverse are popular today as companies ranging from Disney to Facebook (that changed its name to Meta) and Walmart are aiming to define their own brand niches in this new digital space to work and play. Microsoft is no exception, and gaming is part of Microsoft’s metaverse strategy as shared in the company’s press release out Tuesday.

Microsoft has apparently been preparing for the metaverse for several years, buying up gaming studios and talking publicly about the idea for a while now. The company bought Mojang, the creator of “Minecraft” back in 2014. In 2020, Microsoft acquired ZeniMax Media, parent of Bethesda gaming studio in 2020 for $7.5 billion

“As the virtual and physical worlds converge, the metaverse…is emerging as a first-class platform.”

During Microsoft’s April 2021 quarterly earnings call, CEO Satya Nadella discussed the growing significance of the metaverse where the gaming community of "Minecraft" and Microsoft’s 140 million monthly users could develop into large metaverse economies. He even compared the metaverse to the way the Internet was perceived in the 1990s at the company’s Ignite November 2021 conference.

While Microsoft currently does not offer a virtual reality headset used for immersive gaming, Nadella pointed out that “Minecraft” game modifications alone have raked in over $350 million through the construction of new landscapes for players to enjoy and Microsoft has earned profits off in-game purchases through these communities. Reporting on in-game purchases by Research and Markets estimated sales over $34 billion in 2021. Candy Crush alone is expected to attract over $1 billion a year from in-app purchases.

Microsoft’s metaverse ambitions are not tied to gaming alone as the company launched its own Mesh cloud collaboration service in 2021 to offer virtual 3D business meetings and previously described its goals for an “enterprise metaverse” at its Build conference in May of last year. This metaverse “digital twin” to physical infrastructure can be used to track products from manufacturing to delivery more easily.

Sony Braces Itself

Tuesday’s announcement sent shock waves to Sony, the Japanese entertainment giant, who saw stocks plunge as much as 12.8% while small gaming studio stocks went up as possible acquisitions. Sony could suffer if Microsoft pulls Activision titles out of its consoles and makes them exclusive to Xbox, which could result in a loss of 10-30 billion yen ($87-$260 million) from royalty profits. The larger concern however is that the deal could change the industry significantly where gamers shift to Xbox and away from Sony’s Playstation. Microsoft also offers cloud capabilities, enabling gaming on mobile devices beyond consoles.

While Sony has significant financial reserves, it has about 1/8th the operating profit of Microsoft, according to S&P Global Market Intelligence. Competing for Sony may involve more game studio acquisitions and increasing its own battle stations — content libraries. Its large Hollywood studio and music label can offer significant benefits in this regard.